It’s amazing but almost 70% of insureds in Minnesota have purchased from the same company for at least the last four years, and nearly half have never even compared rates from other companies. The average driver in the United States can cut their rates by as much as 47% a year just by comparing rates, but they underestimate the rate savings if they switched to a more affordable policy.

It takes a few minutes, but the best way to get more affordable auto insurance rates in Minneapolis is to make a habit of regularly comparing prices from companies who provide car insurance in Minnesota. Price quotes can be compared by following these steps.

It takes a few minutes, but the best way to get more affordable auto insurance rates in Minneapolis is to make a habit of regularly comparing prices from companies who provide car insurance in Minnesota. Price quotes can be compared by following these steps.

- Learn about coverages and the measures you can take to drop your rates. Many things that result in higher prices such as multiple speeding tickets and an unfavorable credit rating can be amended by making small lifestyle or driving habit changes.

- Compare prices from independent agents, exclusive agents, and direct companies. Exclusive agents and direct companies can only quote rates from a single company like GEICO or State Farm, while independent agencies can provide rate quotes from multiple companies.

- Compare the new quotes to the price on your current policy to see if a cheaper price is available. If you can save money, make sure there is no coverage gap between policies.

The key aspect of shopping around is to make sure you enter identical limits and deductibles on every quote request and and to get prices from as many companies as possible. Doing this guarantees a level playing field and a complete rate analysis.

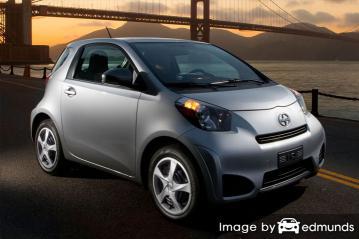

The best way we recommend to get policy rate comparisons for Scion iQ insurance in Minneapolis is to realize almost all companies allow for online access to give free rates quotes. All consumers are required to do is give the companies some data such as marital status, how much coverage you want, if you require a SR-22, and if it has an anti-theft system. That information is instantly provided to insurance companies and they respond with quotes immediately.

To find the cheapest Scion iQ insurance rates, click here and enter your coverage details.

The companies shown below provide price quotes in Minneapolis, MN. If you want to find the best car insurance in MN, we suggest you visit several of them in order to find the cheapest rates.

What insurance coverages do I need?

When buying adequate coverage for your vehicles, there really is no “best” method to buy coverage. You are unique.

For example, these questions can aid in determining whether you may require specific advice.

- When should I not buy collision coverage?

- Does coverage extend to my business vehicle?

- How much coverage applies to personal belongings?

- How high should deductibles be on a Scion iQ?

- Can I rate high risk drivers on liability-only vehicles?

- Will I be non-renewed for getting a DUI or other conviction?

If you can’t answer these questions but you know they apply to you, you might consider talking to a licensed insurance agent. To find an agent in your area, complete this form. It’s fast, doesn’t cost anything and can help protect your family.

Local Minneapolis car insurance agents and auto insurance

A small number of people still prefer to sit down and talk to an agent and that can be a great decision Licensed agents will help you protect your assets and help in the event of a claim. The best thing about comparing rates online is the fact that drivers can get the best rates and still have a local agent.

For easy comparison, once you complete this simple form, your insurance coverage information is transmitted to companies in Minneapolis who will give competitive quotes for your insurance coverage. There is no reason to contact an agency because prices are sent immediately to your email address. If you have a need to compare prices from a particular provider, you just need to navigate to their website to submit a rate quote request.

For easy comparison, once you complete this simple form, your insurance coverage information is transmitted to companies in Minneapolis who will give competitive quotes for your insurance coverage. There is no reason to contact an agency because prices are sent immediately to your email address. If you have a need to compare prices from a particular provider, you just need to navigate to their website to submit a rate quote request.

Picking the best insurer requires more thought than just a cheap price quote. A good agent in Minneapolis will have answers to these questions.

- How long have they worked with personal auto insurance coverage?

- Will high miles depreciate repair valuations?

- Did they already check your driving record and credit reports?

- Which family members are covered?

- Do they have advanced training designations such as CPCU, AAI, AIC, or CIC?

How to choose the best car insurance agent in Minneapolis

When searching for a local agent, you must know there are a couple different agency structures and how they can write your policy. Auto insurance agencies are either independent or exclusive depending on the company they work for. Either one can provide auto insurance policies, but it’s worth mentioning the difference in how they write coverage because it may have an impact on your selection of an agent.

Exclusive Insurance Agencies

Agents in the exclusive channel can only quote rates from one company such as State Farm, AAA, Farmers Insurance or Allstate. These agents are not able to shop your coverage around so always compare other rates. Exclusive agents are highly trained in insurance sales and that enables them to sell even at higher rates. Consumers sometimes choose to use a exclusive agent mainly due to the brand legacy rather than having low rates.

Below are Minneapolis exclusive agents who may provide you with rate quotes.

- Kelly Mulligan Allstate Insurance Agency

80 8th St S – Minneapolis, MN 55402 – (612) 713-9253 – View Map - John Arens – State Farm Insurance Agent

3259 Johnson St NE – Minneapolis, MN 55418 – (612) 781-3454 – View Map - AAA Minneapolis Insurance

5400 Auto Club Way – Minneapolis, MN 55416 – (952) 927-2518 – View Map

Independent Agents

Agents in the independent channel do not sell for just one brand so they can insure your vehicles with a variety of different insurance companies and find you the best rates. To move your coverage to a new company, they simply move the coverage in-house which requires no work on your part.

When shopping rates, you should always include price quotes from several independent agencies for maximum quote selection. Many can place coverage with less well-known companies which could offer lower prices.

Shown below is a list of independent insurance agencies in Minneapolis willing to provide price quotes.

- Patrick J. Thomas Agency

121 S 8th St #980 – Minneapolis, MN 55402 – (612) 339-5522 – View Map - Semlak Miernicki Insurance Agency

2657 Dupont Ave S – Minneapolis, MN 55408 – (612) 208-0873 – View Map - Cheap Car Insurance Minneapolis Auto Insurance Agency

2227 W 21st St – Minneapolis, MN 55405 – (612) 425-1616 – View Map

After you get good responses to your questions and locked in a price quote, most likely you have located a car insurance agent that meets the criteria to service your policy.